Introduction

Reliance Industries, a conglomerate synonymous with innovation and growth, recently hosted its 46th Annual General Meeting (AGM), marking a year of progress and change. This event not only offers insights into the company’s performance but also sheds light on the dynamic shifts within its shareholder base over the past year. In this blog post, we’ll delve into the evolution of Reliance’s shareholder base, exploring how it has transformed and what this signifies for the company’s future.

The Shareholder Base: A Key Pillar of Corporate Governance

Before delving into the specifics of the changes within Reliance Industries’ shareholder base, let’s understand the significance of this aspect of corporate governance. Shareholders are the ultimate owners of a company, and their composition can greatly influence a company’s direction, decisions, and long-term strategy. The changes within a shareholder base often reflect broader market trends, investor sentiment, and the company’s own performance.

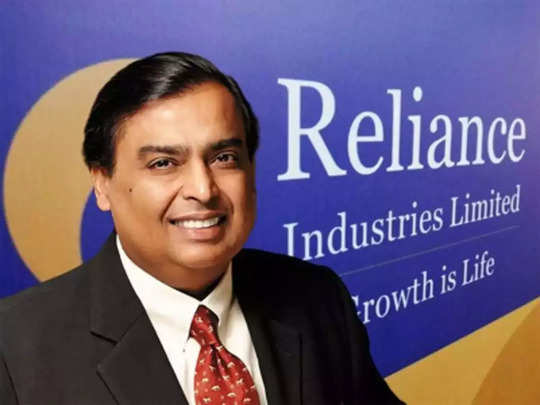

Reliance Industries: A Snapshot

Reliance Industries, led by visionary entrepreneur Mukesh Ambani, has carved a niche for itself across various sectors, including energy, petrochemicals, telecommunications, and retail. Its diverse portfolio has attracted a wide range of investors, from retail individuals to institutional giants.

The Dynamics of Change: How the Shareholder Base Evolved

1. Institutional Investors Stepping In

In the past year, Reliance Industries witnessed a significant increase in the presence of institutional investors within its shareholder base. These institutional investors, including mutual funds, pension funds, and insurance companies, often carry substantial financial clout. Their involvement indicates a strong vote of confidence in the company’s growth trajectory and potential. These entities conduct in-depth analyses before investing, which highlights the robustness of Reliance’s financials and strategic vision.

2. Foreign Institutional Investors (FIIs) and Global Attention

The 46th AGM revealed another interesting facet: an uptick in foreign institutional investors’ interest. Global investors, attracted by Reliance’s innovative ventures like Jio Platforms and its transformative impact on India’s digital landscape, have been keen to secure their share. This international interest underscores Reliance’s status as a global player and signals a broader acknowledgment of India’s emerging market potential.

3. Retail Investors: A Continued Pillar

Reliance Industries’ relationship with retail investors remains steadfast. These individual shareholders, often with a personal connection to the company’s products and services, have been a key driving force behind its journey. The company’s initiatives to engage with retail investors through loyalty programs, discounts, and special offers have contributed to this unwavering support. Despite the influx of institutional and foreign investors, Reliance recognizes the importance of maintaining a strong connection with its retail base.

Key Takeaways from the Evolution

1. Diversification of Risk

The evolving shareholder base is indicative of Reliance Industries’ deliberate effort to diversify risk. By attracting institutional and foreign investors alongside retail shareholders, the company reduces its dependence on any single group. This diversification safeguards the company from sudden market shocks or sector-specific challenges.

2. Reinforced Confidence

The heightened presence of institutional and foreign investors serves as a vote of confidence in Reliance Industries’ strategies and prospects. Their rigorous due diligence processes and long-term investment perspectives reinforce the company’s credibility and growth potential.

3. Global Recognition

The increased interest from foreign investors places Reliance Industries on the global investment map. It’s not just a national success story; it’s a contender in the global corporate arena. This recognition can have far-reaching implications, including increased partnerships, collaborations, and potential expansion beyond Indian borders.

Future Implications and Conclusion

The transformation of Reliance Industries’ shareholder base over the past year underscores its resilience, adaptability, and strategic prowess. The diversification of investors, ranging from institutional giants to foreign players, paints a picture of a company poised for long-term success. As the conglomerate continues to innovate and expand its footprint, these changes within the shareholder base serve as a compass, guiding the company towards new horizons.

In conclusion, the 46th AGM of Reliance Industries provided a comprehensive view of how its shareholder base has evolved in just one year. This evolution reflects broader market trends, investor sentiments, and the company’s own strategic decisions. The conglomerate’s ability to attract diverse investors while maintaining its core retail base speaks volumes about its resilience and future prospects on both national and international stages. As we eagerly await the company’s next chapter, it’s clear that Reliance Industries is not just a business entity; it’s a narrative of transformation and growth that resonates with investors across the spectrum.